Frequently Asked Questions

Opening An Account

A 529 plan is a tax-advantaged investment account that is designed to grow savings for future education expenses for a specified beneficiary. 529 plans offer unique benefits and features that make them an appealing strategy for education related saving.

Any person at least 18 years old with a valid Social Security Number (SSN) or Tax Identification Number (TIN) can open a 529 account. The account holder chooses the investment options, designates a beneficiary, and requests the distribution of funds.

A 529 plan can be used for “qualified educational expenses.” For federal tax purposes, qualified educational expenses include:

-

Tuition and fees at accredited higher education institutions

-

Books

-

Supplies and equipment

-

Room and board for beneficiaries attending on at least a half-time basis.

-

Computer technology, equipment, and internet access

-

Up to $10,000 a year for K-12 tuition and expenses (Limit increase to $20,000 in 2026)

-

Expenses for educational special needs services

-

Transfers to an ABLE account for the beneficiary (transfer subject to annual limit)

-

Apprenticeship expenses

-

Up to $10,000 for student loan repayment

-

Credentialing expenses and certification programs

-

Roth IRA rollover for the beneficiary

If you're not sure if an expense is considered "qualified," we recommend consulting with a tax professional or advisor. Unqualified expenses will be treated like ordinary income: state and federal taxes will apply, with a 10% federal penalty for withdrawals from your 529 plan used to pay for them.

You can open an account with The Education Plan online or by mailing in the enrollment form. In order to open an account, you will need the following information:

-

Your social security number or TIN

-

Your address

-

Your bank account information (in order to fund the account)

-

The beneficiary’s social security number or TIN

-

The beneficiary’s birthday

-

The beneficiary’s address

Any person with a valid Social Security number or Tax ID number (TIN) can be the beneficiary of a 529 plan. The beneficiary and the account owner don’t need to be related. An account owner can open a 529 plan for themselves, a family member, or a friend.

Many families choose to open a 529 account for each child in order to align the investment strategy with the timeline for when the child will need the funds. It can also be helpful to have an account for each child so that friends and relatives can make gift contributions to an individual’s account.

However, you can easily change the eligible beneficiary on your account, so you could also use a single account for more than one child.

There is no additional cost associated with opening an account or owning more than one account.

Yes, a single beneficiary can have more than one 529 account with The Education Plan. For example, a parent can open an account for their child, and a grandparent can open a different account for the same child. The maximum account contribution limit for The Education Plan is $500,000, though earnings may still grow over this limit. This limit applies to all accounts that are opened for a beneficiary.

No, you do not have to be a New Mexico resident to open an account with The Education Plan. The account holder and the beneficiary can be a resident of any state. The beneficiary can use the funds in a 529 account at any accredited institution in the United States, and even at some international institutions.

The Education Plan offers a practical way of approaching education savings. Plan highlights include:

-

Streamlined portfolio options: Our investment menu features diversified options. Year of Enrollment portfolios help make choosing a suitable investment strategy easier Investment Options Keep It Simple | The Education Plan

-

Expertise: Ascensus College Savings Recordkeeping Services, LLC (Ascensus College Savings) serves as program manager for The Education Plan. With millions of accounts administered across the nation, Ascensus brings a wealth of experience to help improve your savings experience.

-

Lower cost: One of The Education Trust Board’s goals is to keep costs low. You can see the see current average cost here.

-

Gifting opportunities: We offer access to Ugift. The Ugift program allows you to easily and securely share your specific 529 plan code with family, friends and coworkers, giving them the opportunity to make gift contributions easily, including online. Upromise lets members earn back a percentage of qualified spending, which can be deposited into their 529 account.

-

Flexibility: you can open an account, even without an initial contribution, and contribute what you want, when you want. Account changes, contributions and withdrawals are easy to manage online, and beneficiaries and ownership are transferable.

Managing Your Account

To recover your username or password, visit the login page and click on Forgot Username or Forgot Password. The system will guide you through the process. You can also contact us for assistance.

Yes. You can change the beneficiary on your account to any qualifying family member of the original beneficiary, this includes:

-

Spouse

-

Son, daughter, stepchild, foster child, adopted child, or a descendant

-

Son-in-law, daughter-in-law

-

Siblings or step-siblings

-

Brother-in-law, sister-in-law

-

Father-in-law, mother-in-law

-

Father or mother or ancestor of either, stepmother, stepfather

-

Aunt, uncle, or their spouse

-

Niece, nephew, or their spouse

-

First cousin or their spouse

You can also move funds from the account of one sibling into the existing account of another sibling without penalties.

To change the beneficiary on your account, you can fill out the Transfer Form or contact us for assistance.

To manage your investment options, log in to your account. Click on “Change Investment Options” in the left-hand menu. The system will walk you through your options. You can also fill out the Change of Investment form and send it in.

You are allowed to exchange or move your existing assets twice per calendar year.

You can change allocations for future contributions at any time.

There are two ways to set up automatic contributions to your account with The Education Plan.

-

Payroll Contributions - If your employer offers it, you can automatically contribute to your 529 plan each time you get paid. Use the Payroll Direct Deposit Form (under the Contributions tab) to set up payroll contributions.

-

Automatic Investment Plan (AIP) - This option allows you to schedule recurring contributions directly from your bank account. Log in to your account and click “Manage recurring contributions” in the left-hand menu to get started.

Rollovers

Yes. You can make one tax-free 529 rollover within a 12-month period per beneficiary.

There are two ways to rollover funds. You can fill out this rollover form, which will coordinate the movement of funds from another 529 plan account into your account with The Education Plan.

If you prefer, you can also handle the rollover yourself by requesting a distribution from your old 529 plan and then depositing the funds into your account with The Education Plan.

Regardless of who does it, the rollover must be completed within 60 days or the funds may be considered a non-qualified withdrawal and taxed accordingly.

How often can I rollover a 529?

You can make one tax-free 529 rollover within a 12-month period per beneficiary. It’s important to note that this rule is per beneficiary, not per plan. If your beneficiary has multiple accounts open for him or her, you will need to coordinate with the other account owners to ensure that only one rollover takes place in a 12-month period.

You can make one tax-free 529 rollover within a 12-month period per beneficiary. It’s important to note that this rule is per beneficiary, not per plan. If your beneficiary has multiple accounts open for him or her, you will need to coordinate with the other account owners to ensure that only one rollover takes place in a 12-month period.

The SECURE 2.0 Act allows you to rollover unused funds from a 529 plan into a Roth IRA account (effective as of 2024) in the name of the designated beneficiary without tax penalties. There are several restrictions in place you must be aware of before you rollover funds.

-

There is a $35,000 lifetime rollover limit per beneficiary

-

The 529 account must be open for the designated beneficiary for at least 15 years

-

Any contributions, and the investment earnings associated with them, made in the last 5 years cannot be rolled over

-

Roth IRA rollovers are subject to the Roth IRA contribution limits for the taxable year

The SECURE 2.0 Act allows you to rollover unused funds from a 529 plan into a Roth IRA account (effective as of 2024) in the name of the designated beneficiary without tax penalties. There are several restrictions in place you must be aware of before you rollover funds.

-

There is a $35,000 lifetime rollover limit per beneficiary

-

The 529 account must be open for the designated beneficiary for at least 15 years

-

Any contributions, and the investment earnings associated with them, made in the last 5 years cannot be rolled over

-

Roth IRA rollovers are subject to the Roth IRA contribution limits for the taxable year

Contributions

There is no annual contribution limit for a 529 plan with The Education Plan. The maximum account balance for The Education Plan for a single beneficiary is $500,000. This includes all accounts for the beneficiary, even if there are multiple account owners.

While there is not an annual contribution limit, you should be aware of the federal annual gift tax limits, which apply to 529 contributions.

You can make a contribution to a 529 account with The Education Plan in a variety of ways These include:

-

Recurring contribution (also known as Automatic Investment Plan)

-

Electronic funds transfer (ETF)

-

Check - make checks payable to The Education Plan, specifying account number

-

Payroll direct deposit

-

Upromise program

-

Rollover contribution

-

Contribution from a UGMA/UTMA account

-

Contribution from an ESA account or a qualified U.S. savings bond

Anyone can make a contribution to a 529 account with The Education Plan. This includes parents, grandparents, relatives and friends. If you want to make a contribution to an existing account, ask the account owner for the unique Ugift code. This will allow you to easily make a contribution through the Ugift program.

If you would like to set up your own account, you can do so with some basic information about the beneficiary, including their social security number, birth date and address.

New Mexico residents can deduct contributions to The Education Plan from their state taxable income each year. This includes contributions made to an account that you are not the account owner of.

You cannot deduct contributions from federal income taxes.

Withdrawals

You will receive Form 1099-Q if you are the recipient of a distribution from a 529 account. Either the account owner or the beneficiary (student) will receive the form, depending on where the funds were sent. The IRS Form 1099-Q reports how much was withdrawn, split between earnings and contributions. The Recipient of this form should determine if any of the withdrawal is taxable based on qualified use of the funds.

A 1099-Q is only sent in tax years when funds are withdrawn from the account.

You can make a withdrawal by logging in to your account and requesting a withdrawal or by filling out and sending in the withdrawal form. Check with the beneficiary’s institution to see if you can make automatic payments from the 529 account directly to the school. The Education Plan can send a check to the institution, to the account beneficiary, or to the account owner. Be sure to maintain records supporting the withdrawal to support qualified withdrawals.

You can use the funds in your 529 account to pay for a wide range of “qualified educational expenses.” This includes tuition at accredited institutions, room and board, K-12 tuition and expenses, and much more. You can see the full list of qualified educational expenses here.

Yes, you can use up to $20,000* a year to cover tuition and expenses for K-12 education.

Qualified K-12 expenses include:

-

Tuition (public, private, and religious)

-

Curriculum materials, books (including digital/online) and instructional materials

-

Tutoring and instructional classes**

-

Fees for a nationally standardized norm-referenced achievement test, an advanced placement examination, or any examinations related to college or university admission

-

Dual enrollment program fees

-

Educational therapies for students with disabilities provided by a licensed or accredited practitioner or provider, including occupational, behavioral, physical, and speech-language therapies

*Starting in tax year 2026. The annual limit is $10,000 in tax year 2025 and permitted for tuition only.

**Tuition for tutoring or educational classes outside of the home, including at a tutoring facility, but only if the tutor or instructor is not related to the student and—

(i) is licensed as a teacher in any State,

(ii) has taught at an eligible educational institution,

or

(iii) is a subject matter expert in the relevant subject.

A non-qualified withdrawal is any distribution from your 529 account that is not used for qualified expenses as defined by federal law (Section 529 IRC).

Qualified expenses include tuition, fees, certain room and board costs, books, supplies, equipment required for enrollment, K–12 tuition and expenses, apprenticeship expenses and more. You can see the full list of qualified expenses here.

Tax implications of non-qualified withdrawals:

-

The earnings portion of a non-qualified withdrawal is generally subject to federal and state income tax.

-

An additional 10% federal penalty tax may also apply to the earnings. There are some exceptions to this rule, including if the student received a scholarship or attended a military academy. See the full list of exceptions in the Plan Description.

-

State tax treatment may differ, and you may lose any state tax benefits previously claimed.

Investments

The Education Plan offers a variety of investment options to fit you and your family’s needs, risk tolerance and goals. You can see all of the available investment portfolios on the investments page.

Also known as an age-based portfolio, Year of Enrollment portfolios automatically move progressively to more conservative investments as your Beneficiary approaches the year of enrollment in post-secondary education. There are Portfolios available under the Year of Enrollment option. These Portfolios invest in underlying funds from various investment managers.

You can find information about fees in the Plan Description.

To manage your investment options, log in to your account. Click on “Change Investment Options” in the left-hand menu. The system will walk you through your options. You can also fill out the Change of Investment form and send it in.

You are allowed to exchange or move your existing assets twice per calendar year. You can change allocations for future contributions at any time.

Tax Benefits

A 529 plan offers several federal tax advantages:

-

Tax-deferred growth: Any investment earnings in your 529 account grow free from federal income tax while the funds remain in the account.

-

Tax-free withdrawals for qualified expenses: When funds are used for qualified education expenses, withdrawals are federally tax-free.

-

Rollovers to Roth IRA (beginning in 2024 under the SECURE 2.0 Act): Certain rollovers from a 529 plan to a Roth IRA for the same beneficiary may also be made without federal income tax or penalty, subject to specific conditions (e.g., account age, contribution limits, and a $35,000 lifetime cap).

Withdrawals not used for qualified expenses are considered non-qualified withdrawals and may be subject to federal income tax on earnings and an additional 10% federal penalty tax.

New Mexico provides generous state tax advantages for residents who contribute to a 529 plan with The Education Plan.

-

No limit to state income tax deduction: Contributions to a New Mexico 529 account with The Education Plan are fully deductible from New Mexico state taxable income, with no cap or limit.

-

Tax-free growth and withdrawals: Just like federal treatment, investment earnings grow free from New Mexico state income tax, and withdrawals used for qualified education expenses are state tax-free.

-

Recapture of benefits: If you take a non-qualified withdrawal, you may have to include previously deducted contributions in your New Mexico taxable income.

Contributions to a 529 plan are treated as completed gifts for federal gift tax purposes, even though the account owner keeps control of the account. This means:

-

You can contribute up to the annual gift tax exclusion amount per beneficiary each year without incurring federal gift tax.

-

For 2025, the annual exclusion is $19,000 per donor, per beneficiary (or $38,000 for married couples who elect to split gifts).

-

529 plans also allow a special five-year election: you can contribute up to five times the annual exclusion amount at once (currently $95,000 per donor, or $190,000 for married couples) and spread evenly over five years for gift tax purposes.

-

Be sure to consult a tax expert about the treatment of contributions and the relative tax limits and implications.

The five-year gift tax election is a special feature of 529 plans that allows you to make a large, one-time contribution and spread it out for federal gift tax purposes:

-

You may contribute up to five times the annual gift tax exclusion amount to a single beneficiary in one year.

-

For 2025, that means up to $95,000 per donor (or $190,000 for married couples who elect to split gifts).

-

The contribution is then treated as though it were made in equal amounts over five years, avoiding federal gift tax as long as you make no additional taxable gifts to that beneficiary during the five-year period.

-

If you pass away during the five-year period, a prorated portion of the contribution may be included in your taxable estate.

This election provides families with a way to jump-start a beneficiary’s 529 savings while still receiving favorable gift tax treatment.

Gifting

They say it takes a village to raise a child. For many, achieving future education goals can also take a village.

Accepting gifts into your account with The Education Plan is a simple way to harness the power of friends and family to help boost your loved one’s savings for future education. A contribution to an education savings account is a meaningful gift, and many people are happy to contribute — once they know how.

Share the Ugift Link and the Code with Loved Ones.

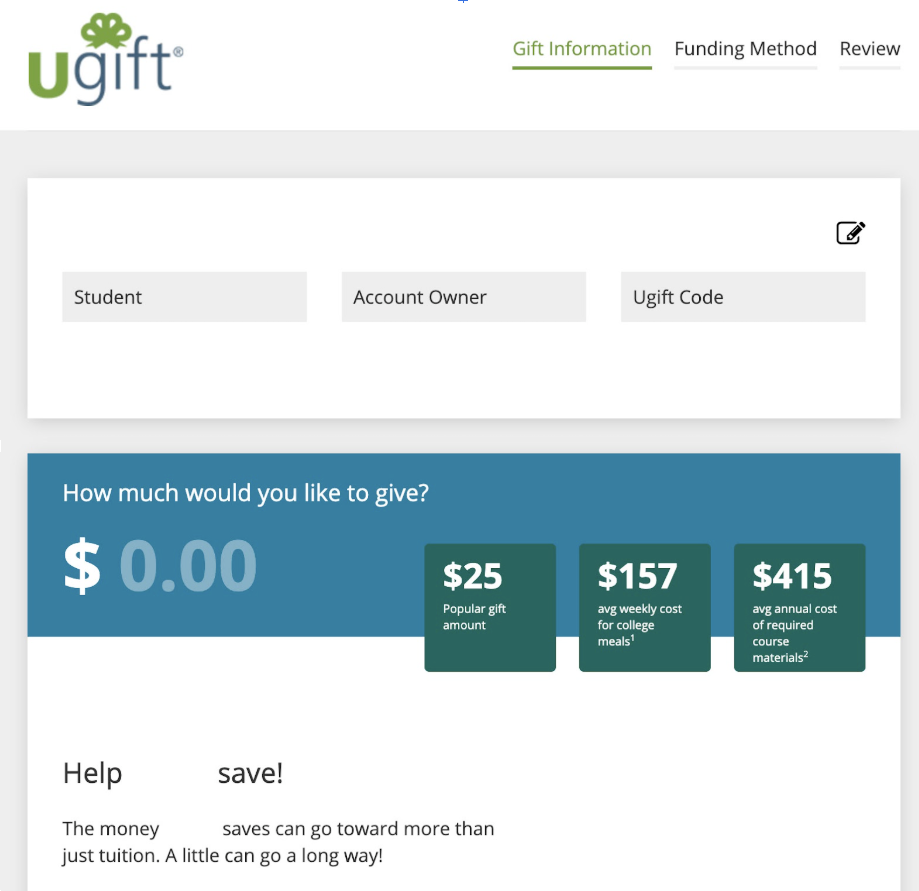

When a loved one is ready to make a gift, direct them to ugift529.com. They can enter the code you shared to make a contribution directly into the beneficiary’s account.

Once they enter the code, they will be able to confirm the Beneficiary and Account holder, and then choose the amount they would like to contribute.

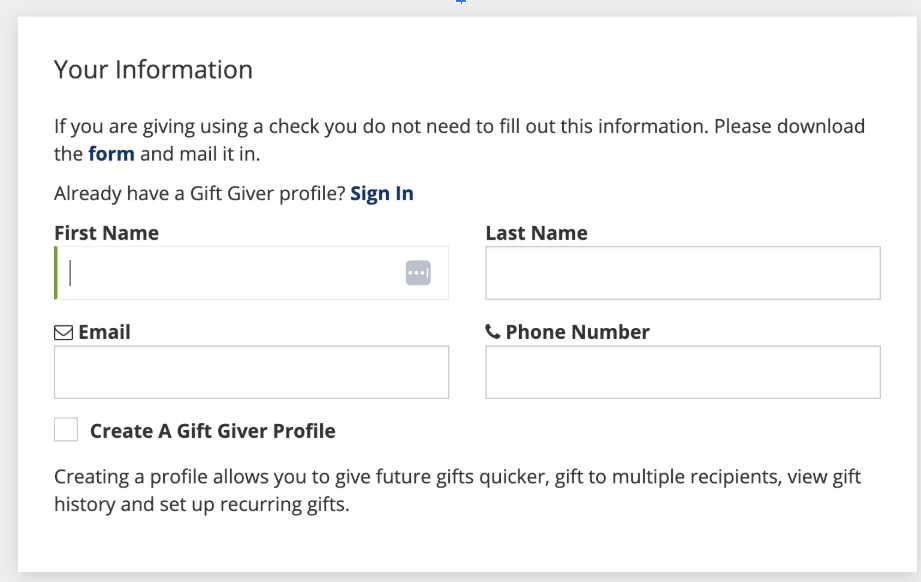

They will then be asked to share some information. They can even set up a gift giver profile to make repeat contributions easy.

Ready to share your Ugift code with your loved ones? Here are a few tips on how to ask for a contribution.

Family and friends can contribute to an account with The Education Plan through Ugift, either in connection with a special event or to provide a gift to the beneficiary. To set your account up to be able to accept gift contributions through Ugift:

Friends and family are often excited to give a meaningful gift like a 529 contribution to a child in their life. We have compiled tips for asking for a gift contribution here.

Financial Aid And Planning

The impact of a 529 plan on financial aid will depend on who is the account owner.

Here’s how it works:

-

The government considers funds deposited in a 529 account as the account holder’s assets. If you open a 529 plan for your child, you'll be the owner of the plan and your child, presumptively, will be the beneficiary.

-

Most colleges use the Free Application for Federal Student Aid (FAFSA) form to determine a student’s eligibility for federal financial aid. The information you provide in the form will be used to calculate your expected family contribution (EFC). Your EFC reflects the amount that your family is expected to contribute towards your child’s college education. This also impacts how much financial aid your child may receive.

-

The impact a 529 plan will have on your child’s eligibility for financial aid will depend on who owns the account.

If the Account is Owned by Parents

For parents, EFC is calculated at the most favorable rate — a maximum of 5.64%.

If the Account is Owned by the Student

If the student is the account owner of the 529 plan, the funds in the account would be treated as their own assets, and the EFC would be calculated at 20% of the account’s value.

If the Account is Owned by Grandparents, Relatives or Friends

With the implementation of the FAFSA Simplification Act in the 2024-25 academic year, 529 plans owned by friends, relatives, and grandparents will not be considered student assets.

Thus, withdrawals from these accounts will not count as student income.

Before the FAFSA Simplification Act, students needed to report any withdrawals from non-parent-owned 529 accounts while filling out FAFSA forms. Such funds were considered unearned income, with FAFSA counting 50% of the income as EFC.

With the new rules in place, grandparents, friends, and other relatives who are willing to contribute to the education of a loved one can open a 529 plan without worrying about hurting the child’s eligibility for financial aid.

With the implementation of the FAFSA Simplification Act in the 2024-25 academic year, 529 plans owned by friends, relatives, and grandparents will not be considered student assets.

Thus, withdrawals from these accounts will not count as student income.

Before the FAFSA Simplification Act, students needed to report any withdrawals from non-parent-owned 529 accounts while filling out FAFSA forms. Such funds were considered unearned income, with FAFSA counting 50% of the income as EFC.

With the new rules in place, grandparents, friends, and other relatives who are willing to contribute to the education of a loved one can open a 529 plan without worrying about hurting the child’s eligibility for financial aid.

If you don’t use all the money in your account with The Education Plan, you have several options:

-

Change the beneficiary. You can transfer the funds to another eligible member of the original beneficiary’s family.

-

Rollover to a Roth IRA. Beginning in 2024, federal law allows certain rollovers from a 529 plan to a Roth IRA for the beneficiary, subject to requirements like a lifetime $35,000 cap and the account being open for at least 15 years.

-

Keep the funds in the account. There is no limit to how long funds can be kept in a 529. With career changes, a beneficiary may decide in the future to return to school for another degree or pursue a professional credential.

-

Withdraw the funds. You may take a withdrawal at any time. However, if the money is not used for qualified education expenses or rolled over to another eligible account, the earnings portion will generally be subject to federal and state income taxes, plus a 10% federal penalty.

There are qualified educational expenses you can use the funds in a 529 account for outside of a traditional college education. These include:

-

K-12 tuition and expenses

-

Apprenticeship expenses

-

Vocational and trade school tuition and expenses

-

Credentialing fees and expenses

You can see the full list of qualified educational expenses here.

The cost of college continues to rise, including tuition, housing, food and supplies, so it’s important to begin saving as soon as possible. You can learn more about how much a typical college education costs on our Cost of College page. It’s never too early or too late to start.

You can use the funds in an account with The Education Plan for any accredited institution in the United States, and even many international schools. To determine if a school is eligible:

1. Check the Institution's Eligibility

529 plans can only be used at schools that are eligible to participate in federal financial aid programs.

Use the Federal School Code Lookup Tool:

-

Go to the Federal Student Aid website.

-

Search for the institution by name or location.

-

If the school has a Federal School Code, it is considered eligible for 529 funds.

2. Confirm Directly With the School

Once you've identified the school:

-

Contact the financial aid office or bursar's office.

-

Ask specifically if they are eligible for Title IV federal financial aid programs.

-

Schools that qualify under Title IV are eligible for 529 plan withdrawals.

Get answers to frequently asked questions about 529 plans, The Education Plan, and ways to save for education.

Download this document containing the frequently asked quesions of The Education Plan.

Yes, you can use up to $20,000 per year to pay for K-12 tuition and expenses. Qualified K-12 expenses include:

- Tuition (public, private, religious, and homeschool)

- Curriculum materials, books (including digital/online) and instructional materials

- Tutoring and instructional classes**

- Fees for a nationally standardized norm-referenced achievement test, an advanced placement examination, or any examinations related to college or university admission

- Dual enrollment program fees

- Educational therapies for students with disabilities provided by a licensed or accredited practitioner or provider, including occupational, behavioral, physical, and speech-language therapies

Not all states consider K-12 expenses a qualified expense. You should make sure you understand your state's definition of qualified expenses before deducting money from a 529 for K-12 tuition.

*Starting in tax year 2026. The annual limit is $10,000 in tax year 2025.

**Tuition for tutoring or educational classes outside of the home, including at a tutoring facility, but only if the tutor or instructor is not related to the student and—

‘‘(i) is licensed as a teacher in any State,

‘‘(ii) has taught at an eligible educational institution,

or

‘‘(iii) is a subject matter expert in the relevant subject.

A 529 plan typically has a minimal effect on financial aid, but it varies by situation. Federal financial aid is a needs-based award and is determined by the cost of attendance (the total amount school will cost for one year) and the expected family contribution (based upon the income and assets of both the parents and the student).

A 529 plan does not count as an asset of the beneficiary. If a 529 plan is held by the parents, it does count as an asset of the parents. If the 529 plan is owned by someone else, such as a grandparent, the 529 plan does not count as an asset of the beneficiary.

Many students and their families use student loans. But saving using a 529 plan can help students finance a debt-free education. Student loans need to be paid back, while 529 plans offer the opportunity to save as little or as much as you like.

Qualified higher education expenses for federal tax purposes include:

- Tuition and fees

- Books

- Supplies and equipment

- Room and board for beneficiaries attending on at least a half-time basis.

- Computer technology, equipment, internet access

- Expenses for educational special needs services

- Up to $20,000 a year for K-12 tuition

- Transfers up to $17,000 a year to an ABLE account for the beneficiary

- Apprenticeship expenses

- Up to $10,000 for student loan repayment

- Roth IRA Rollovers

- Credentialing Expenses

To make a withdrawal from your account with The Education Plan, download our withdrawal request form or contact us at 1-877-337-5268, Monday through Friday, 8:00 a.m.– 7:00 p.m. MT.

The cost of college continues to rise, including tuition, housing, food and supplies, so it’s important to begin saving as soon as possible. It’s never too early or too late to start.

There are several types of savings options available:

- 529 plans

- UGMA/UTMA

- Coverdell Education Savings Accounts (CESAs)

- Series EE Savings Bonds

- Taxable Savings Accounts

Yes. A 529 plan can be used for four-year colleges and universities, vocational school, community college, some foreign institutions, and qualified kindergarten through 12th-grade tuition and expenses, student loan replayment, apprenticeship expenses, and transfers to ABLE accounts.

Yes. The account owner can roll over funds from one 529 plan to another with certain limitations. If you are a current account owner, download our rollover form.

Any person over 18 with a valid Social Security number may open an account. The account holder selects the investment options, the beneficiary, and requests the distribution of funds.

Any person with a valid Social Security number or Tax ID number can be the beneficiary of a 529 plan. The beneficiary and the account owner don’t need to be related. An account owner can open a 529 plan for themselves or a family member or friend.

An account owner may change the beneficiary at any time. There are no tax consequences if you change the beneficiary to a family member of the current beneficiary. However, you should consult with your tax professional regarding your specific circumstances.

The Education Plan offers a practical way of approaching education savings. Plan highlights include:

- Streamlined portfolio options: Our enhanced investment menu features fewer, yet more diversified options. Enrollment year-based portfolios help make choosing a suitable investment strategy easier.

- Expertise: Ascensus College Savings Recordkeeping Services, LLC (Ascensus College Savings) manages The Education Plan. With over 4.5 million accounts administered, Ascensus brings a wealth of experience to help improve your saving experience.

- Lower cost: Our total asset-based fees are just 0.10-0.44%.

- Gifting opportunities: We offer access to Ugift and Upromise. Ugift allows you to easily and securely share your 529 plan account information with family, friends and coworkers, giving them the opportunity to make gift contributions online. Upromise lets members earn back a percentage of qualified spending, which can be deposited into their 529 account.

- Flexibility: you can open an account with just $1 and contribute what you want, when you want. Account changes, contributions and withdrawals are easy to manage online and beneficiaries and ownership are transferable.

A 529 plan is a tax-advantaged education investment plan designed to grow savings for future education expenses for a specified beneficiary. 529 plans offer unique benefits and features that make them a very appealing strategy for education planning that can significantly reduce the burden of student loan debt.